TaxesToGo™

Simplifying Your Tax Filing

• TaxesToGo™ offers one of the easiest, most flexible, and most secure ways to complete and file your tax return with your tax preparer.

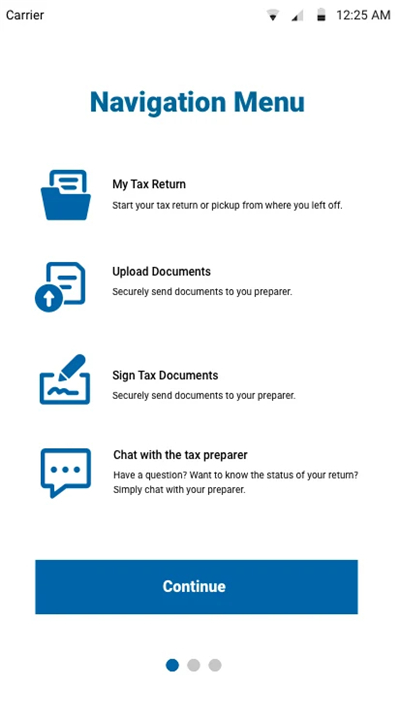

• Designed for convenience, the app allows you to gather, send, and approve your tax return without the hassle of in-person visits.

How It Works

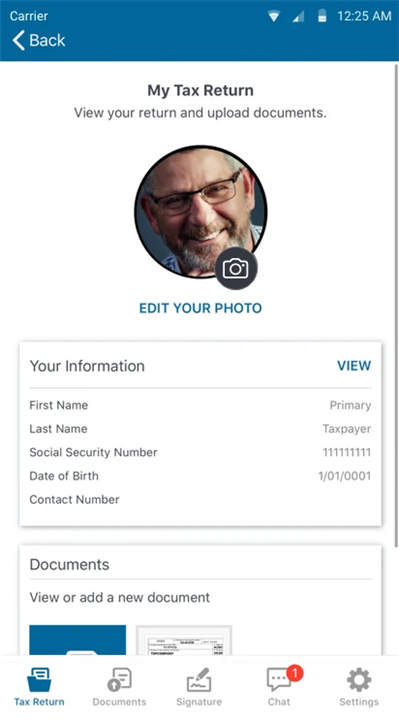

• Capture & Upload – Use your phone or tablet to take clear pictures of your tax documents, including W-2s, 1099s, receipts, and other records.

• Secure Transmission – Send your documents safely to your tax preparer directly through the app.

• Professional Preparation – Your preparer reviews the information, completes your tax return, and sends it back to you for review.

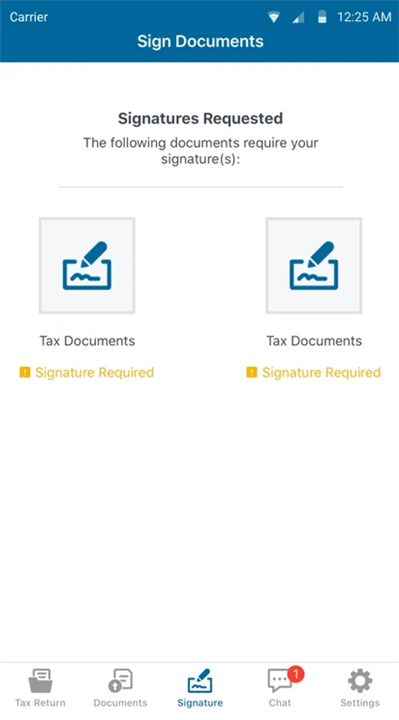

• Remote Approval – Review and sign your completed return electronically, all from your device.

Key Features

• File From Anywhere – No need to schedule office appointments; submit your documents from home, work, or while traveling.

• Remote Signing – Electronically sign your tax forms, eliminating the need for printing or mailing.

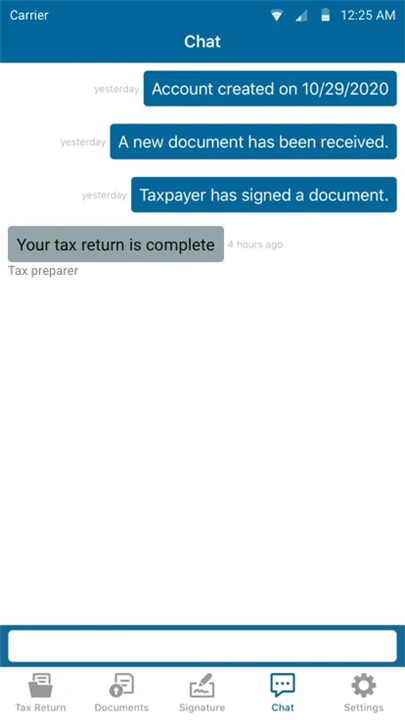

• In-App Communication – Chat directly with your preparer to ask questions, clarify details, or provide additional information instantly.

Why Choose TaxesToGo™

• Secure – Each user is assigned a unique Tax ID number, ensuring that your personal and financial information is transmitted safely.

• Easy to Use – Intuitive design makes it simple to snap photos, upload documents, and approve your return in just a few steps.

• Highly Convenient – Save time by managing the entire filing process from your phone or tablet, without visiting your preparer’s office.

Get Started

• Contact your tax preparer to confirm if they offer the TaxesToGo™ app and begin simplifying your tax filing today.

Disclaimers

• TaxesToGo™ is a private service and is not affiliated with any government agency.

• For official IRS information and resources regarding specific tax requirements, visit:

+ https://www.irs.gov

FAQ

Q: How does the process work from start to finish?

A: Using the app, you’ll first take clear photos of your tax documents like W-2s, 1099s, receipts, or other records. These are sent securely to your tax preparer. They will review, prepare, and send your return back to you for approval. Once you review it, you can sign electronically and your preparer will file it on your behalf.

Q: Do I still have to visit my preparer in person?

A: No, that’s one of the main benefits of TaxesToGo™. You can handle the entire process remotely from your home, office, or even while traveling.

Q: Is it safe to send my personal tax information through the app?

A: Yes. TaxesToGo™ uses secure transmission for all data. Each user is also assigned a unique Tax ID number to further protect personal and financial information.

Version History

v24.2——5 Nov 2025

Tax filing on the go Download the latest version of TaxesToGo to enjoy new features and updates immediately!

*24.2

New features and bug fixes

*24.1

Users can delete their accounts in the app.

*24.0

TaxesToGo release for Tax Year 2024

Ratings and reviews

There are no reviews yet. Be the first one to write one.