The slice app is where finance management becomes a breeze. Whether you're keeping tabs on your daily expenses with a slice account, making lightning-fast payments through slice UPI, automating your bills and recharges, or accessing instant credit with slice borrow, we’re all about making money management enjoyable and transforming every financial action into a delightful experience!

Here’s how it works:

Download the slice app and sign up in just a few seconds – it’s quick, easy, and entirely digital!

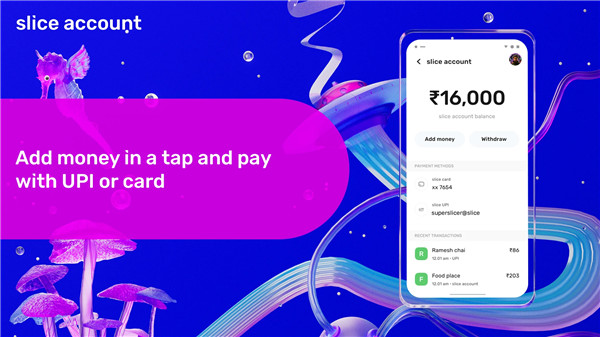

slice account - Your go-to for everyday transactions!

→ No fees, plus all the benefits of a premium digital account!

→ Load funds and glide through your expenses

→ Make payments effortlessly with UPI or debit card

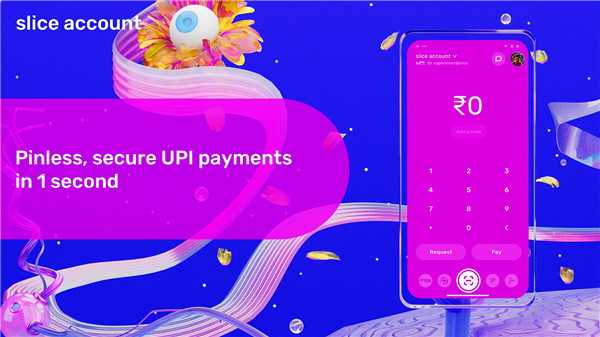

→ Forget the pin! Enjoy pinless UPI payments up to ₹5000 and earn instant cashback, up to double your transaction amount!

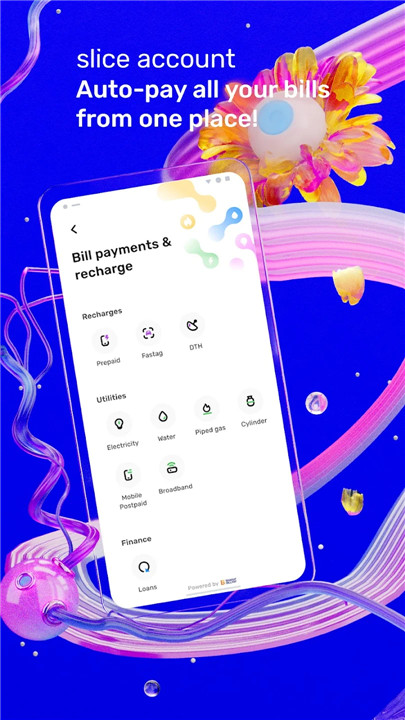

→ Automatically pay all your bills and recharges without hassle

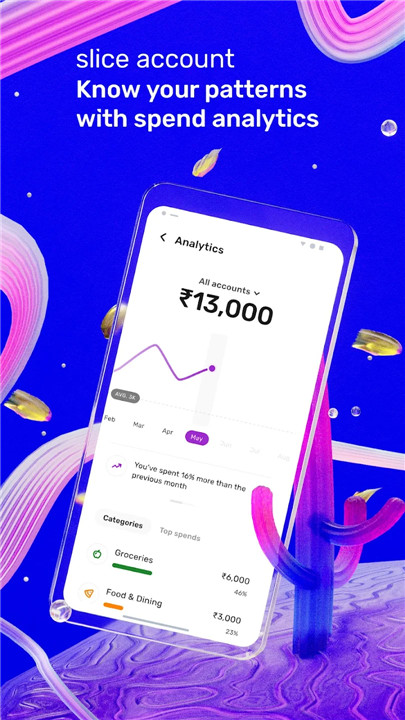

→ Monitor your spending habits with spend analytics

→ Earn 1% instant cashback on every card transaction!

slice bill payments & recharges - All managed from one convenient spot!

→ Effortlessly handle all your recharges - Mobile, DTH, Fastag

→ Manage utility bill payments - electricity, water, LPG, piped gas, broadband - with ease!

→ Quickly take care of loan payments

→ Set up auto-pay for all bills and breeze through your payments!

Spend Analytics - Keep an eye on your spending habits!

→ Monitor all your transactions to identify your spending patterns

→ Gain insights to optimize your expenses

slice UPI - The fastest UPI around!

→ Experience superfast payments in just 2 seconds using QR codes, contacts, UPI IDs, or bank accounts

→ Simply enter the amount, tap, hold to scan, and pay!

→ Instantly transfer money to friends and family in a flash!

→ Visualize your spending locations on a map with our geo-tagging feature!

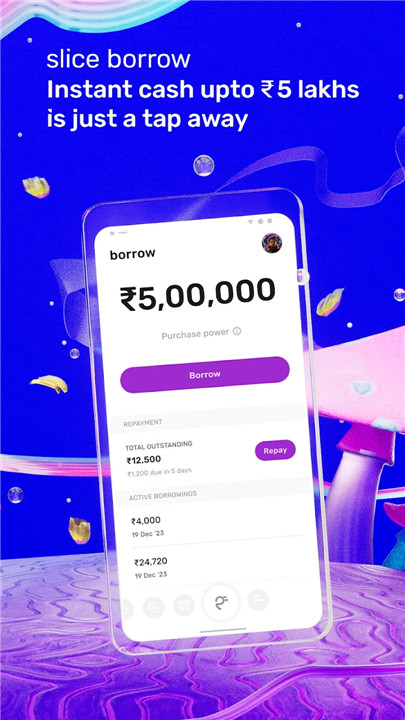

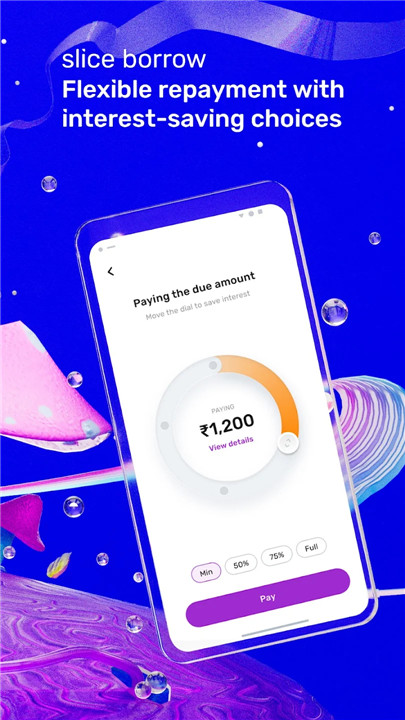

Experience seamless borrowing with flexible repayment options.

→ Get instant access to funds up to ₹5,00,000 in just seconds.

→ Enjoy a completely paperless credit application process.

→ Funds are transferred directly to your bank account instantly.

→ Benefit from flexible repayment plans that help you minimize interest costs.

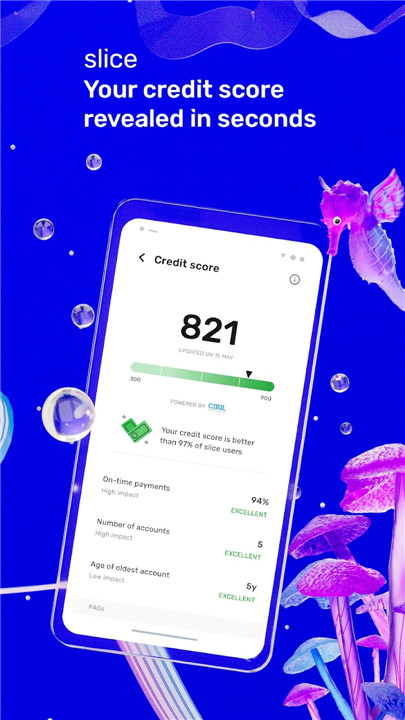

→ Easily check your CIBIL score for free in just a few seconds with slice.

Here’s an example of a slice borrow transaction:

Amount: ₹2,000

Interest Rate: 18%

Processing fee (including GST): ₹60

Disbursal amount: ₹2,000

If repaid over 12 months: ₹2,241

Total interest payable: ₹181

FAQ

Q: What is the Slice app?

A: Slice is a financial management app that aims to make managing your money enjoyable and easy. It offers features like a digital account for daily expenses, lightning-fast UPI payments, automated bill payments, and instant credit through Slice Borrow, all within one convenient app.

Q: How do I get started with Slice?

A: Getting started is quick and easy! Simply download the Slice app from your app store and sign up with a few details. The entire process is digital.

Q: Is there any hidden cost associated with Slice?

A: The Slice account itself is free with no hidden fees for basic transactions. However, certain features like Slice Borrow will have associated interest and processing fees. It's always recommended to carefully review the terms and conditions for each feature before using it.

-----------------

What's New in the Latest Version 14.6.55.1

Last updated on Dec 2, 2024

Feel easy with money Download the latest version of slice 14.6.55.1 to enjoy new features and updates immediately!

bug fixes and enhancements

Ratings and reviews

There are no reviews yet. Be the first one to write one.