Elon Business Fleet – Complete Vehicle Fleet Management Solution

Overview

• Elon Business Fleet is designed to give businesses full control over their vehicle operations.

• From accurate trip logging that complies with the Tax Agency's requirements to real-time location tracking, this system ensures that fleet management is both efficient and compliant.

• Whether you operate company-owned vehicles or benefit cars, all trips are recorded and stored securely in the cloud for easy access and reporting.

Trip Logging and Compliance

• Meets all official Tax Agency requirements for driving records.

• Suitable for both company cars and benefit vehicles.

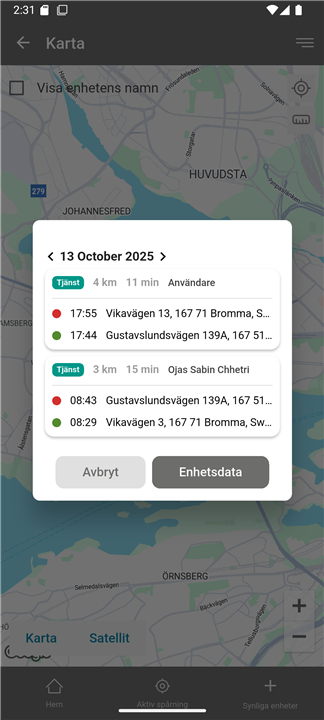

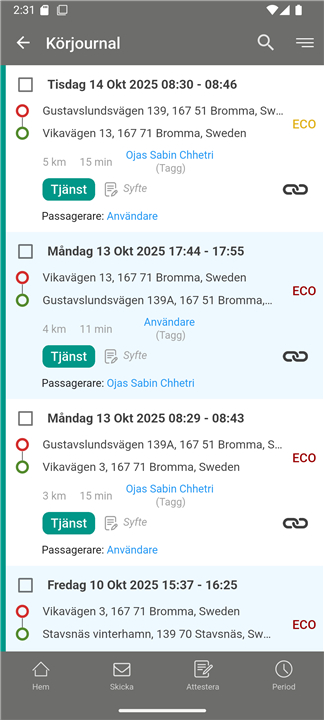

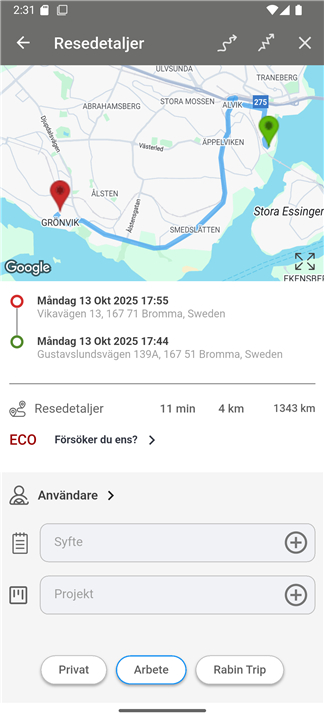

• Automatic logging of all trips with precise start and end times, distances, and routes.

• Cloud storage ensures trip data can be accessed anytime for audits or internal reviews.

Reporting and Administration

• Generate detailed driving reports for submission to finance departments.

• Compile hours driven for client invoicing and project billing.

• Export reports in multiple formats for easy integration with accounting systems.

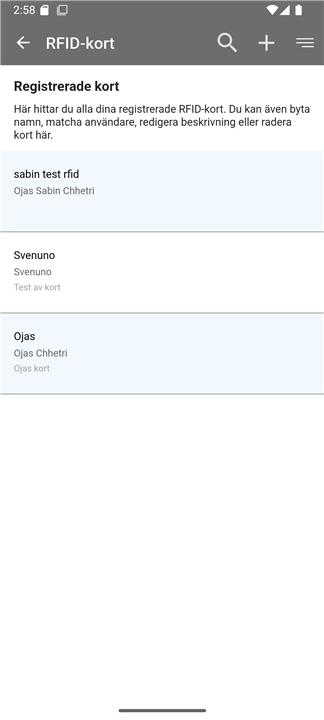

Driver Identification and Access

• Easy driver identification through the mobile app or QR code scanning.

• Ensures accurate tracking of which driver used which vehicle at specific times.

Real-Time Monitoring and Security

• Live tracking of all fleet vehicles through the online dashboard.

• Theft protection with instant alerts if suspicious movement is detected.

• Option to send theft reports directly to police and insurance companies.

• Object description with attached photos for easy asset identification.

Custom Alerts and Notifications

• Receive notifications via email, SMS, or push messages.

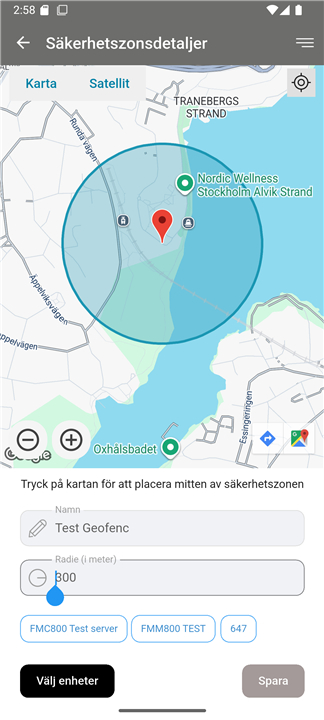

• Create alerts for specific events such as speeding, geofence breaches, or maintenance reminders.

Additional Benefits

• All trip data is automatically saved in the cloud, reducing manual recordkeeping.

• Improves operational efficiency and reduces the risk of lost or incomplete records.

• Enhances both security and compliance for your business vehicles.

FAQ

Q: How does Elon Business Fleet ensure compliance with the Tax Agency’s requirements?

A: Elon Business Fleet meets all official Tax Agency standards by capturing the exact data points needed for compliant driving records. Every trip includes accurate timestamps, distance measurements and GPS-based routes, ensuring that when you’re audited, your logs are fully backed by verifiable digital evidence. The system’s cloud-based archive also makes it easy to retrieve historical records for any reporting period, so you can always demonstrate compliance without scrambling for paperwork.

Q: Can I use Elon Business Fleet for both company cars and benefit vehicles?

A: Absolutely. The platform was developed to handle both types of assets seamlessly. Whether a vehicle is allocated to employees as a company car or provided as a benefit vehicle, trip data is logged in the same way, keeping your records consistent. You can even differentiate between personal and business trips to ensure your benefit-in-kind calculations are accurate.

Q: Where is all the trip data stored, and how secure is it?

A: All trip information is automatically saved in a secure cloud environment, eliminating the risk of lost logbooks or damaged hardware. Data is encrypted both in transit and at rest, providing enterprise-grade security. This means you can access your records from anywhere while trusting that sensitive details are protected against unauthorized access.

Version History

v5.1.7——29 Dec 2025

elon, elon TripLog Download the latest version of Elon Business Fleet to enjoy new features and updates immediately!

*5.1.7

- Automatic DOUT control via NorthTracker's sensor

- Improvements when reading tags

- Improvements when reading sensors

- Minor improvements user interface

- Re-design of the geofence page

- DOUT and configuration improvements

- Minor bugfixes

*5.1.5

Elon Business Fleet’s app keeps improving!

- Support for larger accounts

- Optimization and account management

- Minor bug fixes

*5.1.1

- Bug fixes

Ratings and reviews

There are no reviews yet. Be the first one to write one.